Rental Yield Explained: Why 4% Is Considered a Good Benchmark in Real Estate Investing

When it comes to real estate investing, one metric often sparks debate: rental yield. Many seasoned investors consider a 4% rental yield to be a solid benchmark — but why? In this post, we’ll break down what rental yield means, why 4% is often seen as attractive, and how it compares to other investment options

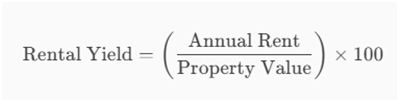

What Is Rental Yield?

Rental yield is the annual return you earn from renting out a property, expressed as a percentage of the property’s market value.

Formula :

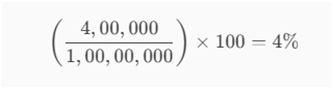

Example :

If you own a property worth ₹1 crore and earn ₹4 lakh annually in rent, your rental yield is:

Why 4% Rental Yield Is Considered Good :

1. Stable Income Stream

Rental income provides consistent cash flow, especially in urban areas with high demand like Mumbai, Bangalore, or Pune.

2. Low Volatility Compared to Stocks

Real estate prices don’t fluctuate daily like equities, making it a safer long-term bet.

3. Capital Appreciation Potential

In addition to rental income, property values often appreciate, boosting overall returns.

4. Tax Benefits

Investors can claim deductions on loan interest, property taxes, and maintenance expenses.

5. Inflation Hedge

Rents tend to rise with inflation, helping preserve purchasing power.

6. Leverage Advantage

If you’ve financed the property with a loan, your return on actual invested capital (down payment) could be significantly higher than 4%

What to Watch Out For

✒ Maintenance Costs & Repairs

✒ Vacancy Periods

✒ Property Taxes & Society Charges

✒ Liquidity Challenges (Real estate isn’t easy to sell quickly)

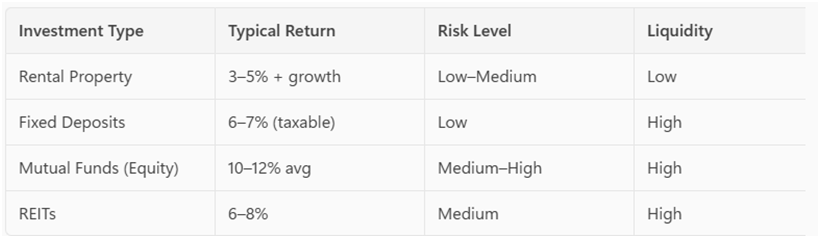

How Does 4% Compare to Other Investments?